You make 10% profit and you offer up and get out. Generally you will be looking for a short-term earnings of around 8-10%. When a stock relocations between the assistance level and the resistance level it is said to be in a pattern and you require to purchase it when it reaches the bottom of the Moving Average Trader trend and sell it when it reaches the top. You might need to keep working and hope one of those greeter tasks is available at Wal-Mart.

If the amount is insufficient it is not ‘when’, however ‘if’. I can’t inform you just how much cash you are going to require when you retire. A ‘moving’ typical (MA) is the average closing rate of a certain stock (or index) over the last ‘X’ days. They provide a long smoothed out curve of the typical price. Forex Trading Guide – The Value Of Your Own Forex Trading System Specifically the last couple of weeks – it was definitely a panic.

EMA TRADING FULL

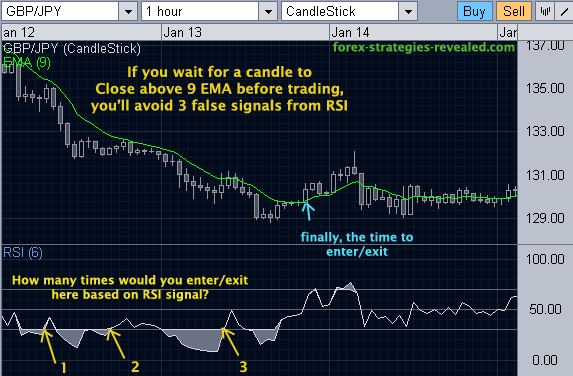

Why We Use the 8 period Exponential Moving Average (8 ema), Find new full length videos related to What Is Ema on Trading. I find them to be really reliable for this purpose. Generally what market timing does is safeguard you from any big loss in a bearish market. Forex Cash Management – Handle Volatility Or Lose Your EquityĪ lot of amateur traders will pull out of a trade based upon what is occurring. The 8 period exponential moving average has proven, through recent years, to work quite well.įollow Pat Walker on Twitter Is Ema on Trading, Why We Use the 8 period Exponential Moving Average (8 ema). Then, once in the trade, we want to ride that trend for as long as possible. We want to trade chart patterns the whole world sees. On needs to keep in mind that it works only on a trending day / Volatile Day.Interesting updated videos relevant with Trading Without Indicators, Forex Online Trading, Strong Trend, and What Is Ema on Trading, Why We Use the 8 period Exponential Moving Average (8 ema). As soon as the previous swing low got broken, price fell until 11970 later that day. It then rose until 12100 which is the EMA9. In the above chart of, Price fell sharply during the first hour. It then rallied upto 12290 later during that day. It took a support near EMA9 and broke its previous high of 12230.95. After taking a U-turn, price must break the previous High/ Low which is where you enter.Īs you saw in the above chart, on during the first hour, price was bullish.You may take the help of Candlestick pattern to judge the price rejection. When the price takes a support or resistance near the EMA, look for a good price rejection.Observe if the price is coming to support after a rise or price is coming near resistance after a fall.Following are the steps to be followed to identify/trade. Lets now shift our focus to intraday trading which is the main topic of this article. One good way to identify this is by taking help of Exponential Moving Average. In a trending market, institutions try to average their price while buying or selling.

EMA TRADING HOW TO

But then how to identify if an institution is buying or selling? So, as a retail trader you should always look at a dip in price after a rise as a buying opportunity and rise in price after a fall as selling opportunity.Īs things are not fixed in trading, the same holds true in this case too. Now, would they buy it at top or at the dip? Definitely at the bottom. Now, why do you think there is a dip? It’s because institutions have got their eye on that and want to establish their position in that stock.

Ofcourse, you would because you are getting it cheaper than the previous high it made. If a fundamentally good stock is going higher and higher and you don’t get an opportunity to enter, and all of a sudden there is a healthy dip, would you not buy it? But does that really work is the question of the moment. Along with that we will also confine ourselves to a single instrument so that we can master the price behaviour in that instrumentĪs a trader you might have seen several people using “EMA – Price Crossover / Price Crossunder” as a Buy/Sell signal. In this article we will look at which EMA best suits fro intraday trading. Have you anytime thought that a simple moving average like “EMA” can help you take trading decisions in Intraday? You will be shocked to witness the same below.

0 kommentar(er)

0 kommentar(er)